SoftBank sets its sights on $9 billion annual investments in AI, with even larger deals on the horizon.

SoftBank is gearing up for a major shift, pledging to invest close to $9 billion annually in artificial intelligence (AI) ventures. This ambitious goal comes alongside their search for even larger acquisitions, potentially marking the company’s most significant transformation yet.

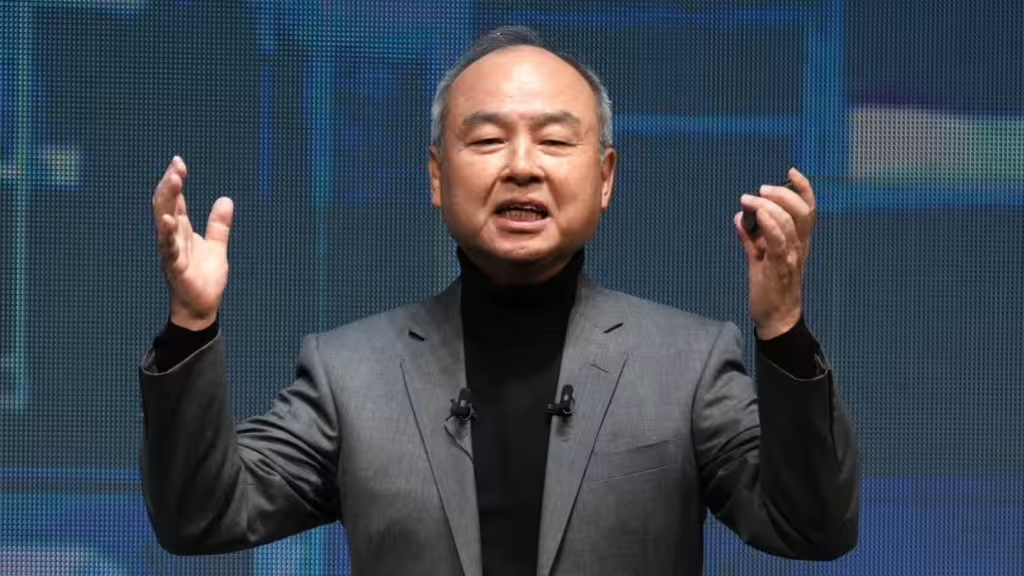

Masayoshi Son, SoftBank’s founder, is a vocal advocate for AI and its potential to reshape the company. He seeks deals that can empower Arm, SoftBank’s crown jewel chip designer whose value has skyrocketed since its IPO last year.

SoftBank’s investment commitment has significantly increased, doubling to $8.9 billion in the past year since Son declared the company’s readiness for a “counteroffensive.” The company vows to maintain or even surpass this amount for the perfect mega-deal.

“We intend to maintain a similar pace in terms of investment activity,” SoftBank’s Chief Financial Officer Yoshimitsu Goto told the Financial Times. “Going forward, we want to prioritize investments in AI companies.”

He further explained that their conservative balance sheet allows them to be prepared and flexible for any potential opportunities.

SoftBank’s journey began as an internet broadband business, then transformed into a mobile phone network giant through acquisitions like Vodafone Japan and Sprint. Later, with support from Saudi Arabia and Abu Dhabi, the company radically transformed into a major investment player, capitalizing on its successful investment in Alibaba.

Son, a firm believer in AI as the future’s driving force, is attempting to reshape SoftBank and its risk-taking Vision Funds to remain relevant in the upcoming era. However, the company faces fierce global competition. Tech giants like Microsoft, Amazon, and Google are pouring billions into partnerships with AI startups, while top venture capital firms actively seek deals with AI product and application developers.

SoftBank has also faced setbacks in recent years, including a massive $14 billion investment in WeWork, the desk-renting startup that went bankrupt. However, the company’s balance sheet has since strengthened, and S&P upgraded SoftBank back to double B plus, its highest non-investment grade, citing an improvement in asset quality.

Image Credits: WebProNews

This financial strength empowers SoftBank for large-scale deals. However, Goto emphasized that they wouldn’t jeopardize their finances in pursuit of such deals. He highlighted the company’s strong loan-to-value ratio and net asset value driven by Arm, indicating their capacity for multi-billion dollar deals.

However, Goto cautioned that investors shouldn’t expect SoftBank to solely finance these ventures or avoid using structured or non-recourse financing methods.

Dealmaking is apparently on the rise. This month, SoftBank led a record-breaking $1 billion investment in Wayve, a UK self-driving car startup. The size and AI focus of the deal attracted Son’s personal involvement, according to Kentaro Matsui, head of new business at SoftBank and a Vision Funds managing partner.

Goto identified potential areas for investment that could benefit both the AI sector and Arm, including power generation and data centers. He declined to comment on rumors of a potential AI chip collaboration between Arm and SoftBank.

According to a source familiar with the situation, SoftBank is also in talks to acquire another UK chip designer, Graphcore. SoftBank declined to comment.

After a year of silence on earnings presentations, Son is expected to speak at SoftBank’s annual shareholder meeting in June. Goto suggests this might be the platform for Son to reveal more details about his AI strategy.

Some investors fear that these plans might distract the company from core businesses like Arm and its telecoms subsidiary, SoftBank Corporation. “The volatility of their investments makes little difference whether they invest $10 billion or $20 billion,” said a long-term investor in Tokyo. “Their success in AI chips hinges on a high-stakes gamble.”

While some investors remain cautious, SoftBank’s internal direction seems clear. The Vision Funds have significantly changed from their earlier days of large investments in startups. They are now prioritizing exits and generating returns, resulting in billions of dollars in sales over the past year.

Furthermore, the Vision Funds are increasingly integrating with SoftBank, dismantling their previously independent structure. This is likely due to the fact that the majority of remaining investment capital for the second Vision Fund belongs to Son himself.

Check out the other AI news and technology events right here in AIfuturize!